carried interest tax loophole

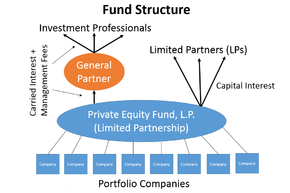

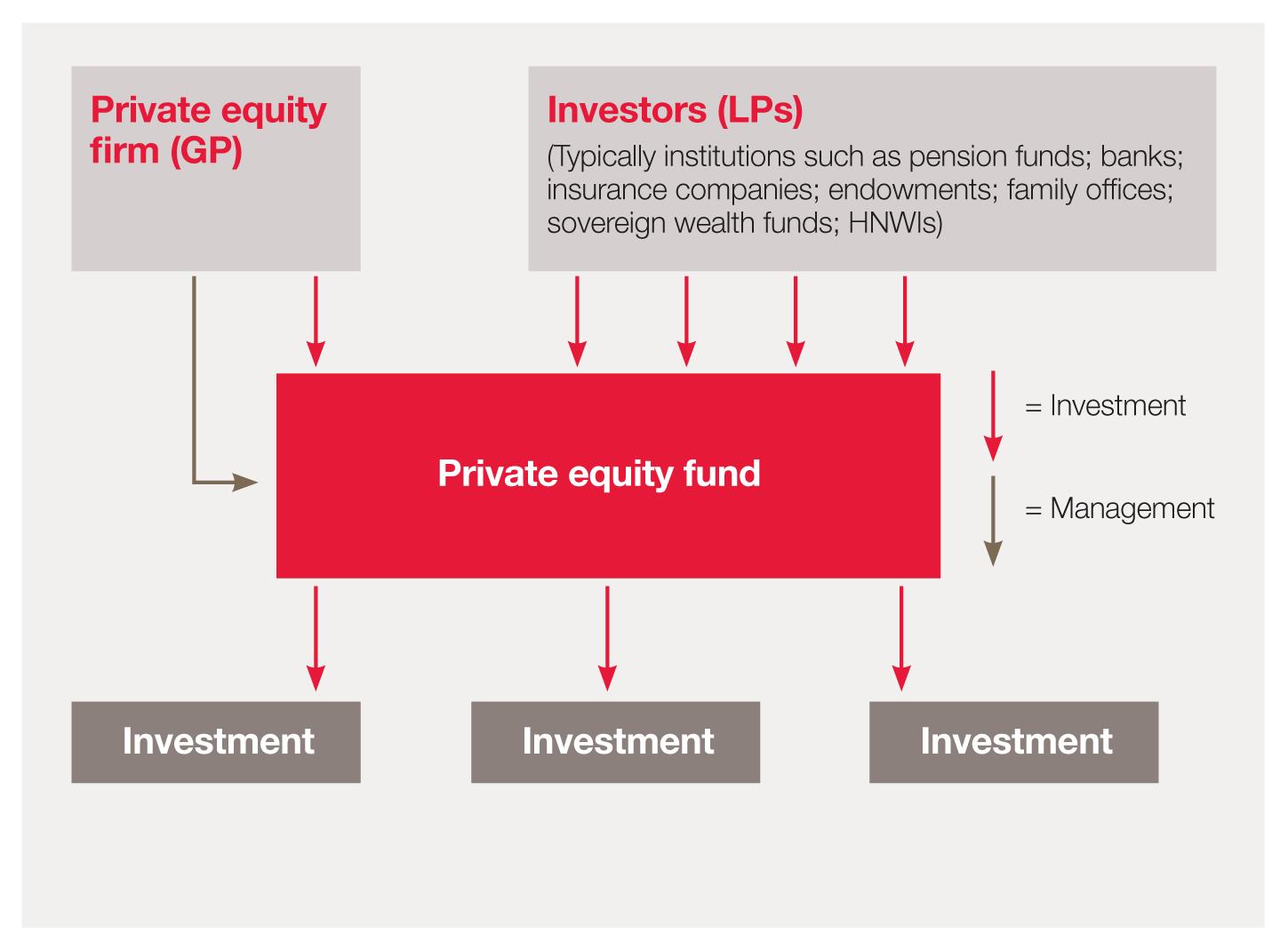

The partner holds the interest as a capital asset and generally recognizes income only when the partnership disposes of its investments realizes income from them or when the partner sells its partnership interest. The lawmakers provided this example.

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

In fact during the 2016 presidential campaign both former-President Donald Trump.

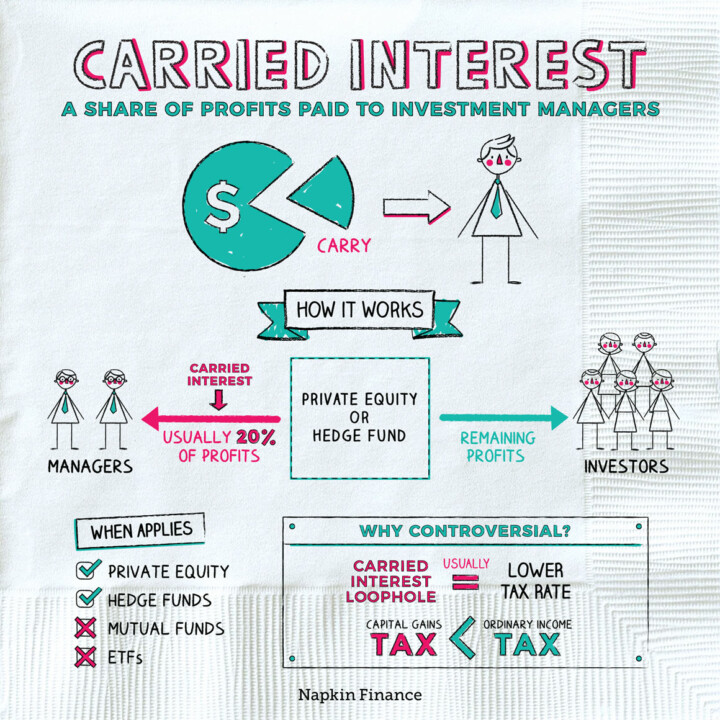

. Carried interest has long been a controversial political issue criticized as a loophole that allows private-equity managers to secure a. We in the tax profession tend to use acronyms and terms that arent always well-known by the masses and Carried Interest is one of those terms. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

The carried interest loophole is unfair to everyone except the fabulously rich who benefit from it Photograph. Some view this tax preference as an unfair market-distorting loophole. Its so absurd that politicians on both sides of the aisle agree that it should be closed but its been kept open because of the vast sums of money spent to preserve it.

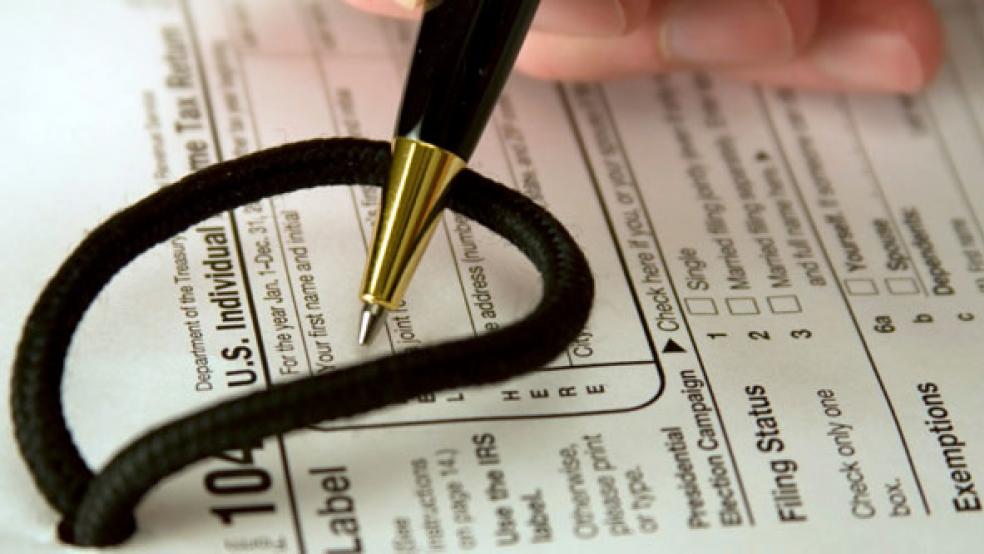

Many politicians want to close the carried interest tax loophole for private equity managers. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that.

Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. Carried interest has long been a controversial political issue criticized as a loophole that allows private-equity managers to secure a reduced tax rate. They see it as a tax loophole that benefits the rich.

However its application and incorporation into a strategic tax plan can be quite complex especially with recent changes in the law. During the last presidential election both Donald Trump and Hillary Clinton vowed to end carried interest. Hedge funds have been able to avoid taxation by using carried interest which allows funds to be treated as.

The top federal rate on dividend income for individual taxpayers is 238 20 for those in the top marginal tax rate plus a 38 net investment tax to fund the Affordable Care Act. WASHINGTONTreasury Secretary Steven Mnuchin said the government will act within two weeks to block a hedge-fund maneuver around part of the new tax law. The concept is simple enough.

In summary the Carried Interest Fairness Act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level and only for taxpayers with taxable income exceeding 400000. Under general principles of partnership taxation the carried interest can be issued by the partnership without current tax. The only problem is no such loophole exists.

Would if enacted tax all or some of carried interest as ordinary income or treat the granting of carried interest as a subsidized loan. The proposed Ending the Carried Interest Loophole Act S. Close the Carried Interest Loophole.

Carried interest allows hedge funds to evade their tax obligations. The carried interest rules are yet another tax loophole to allow wealthy private equity and hedge fund managers to avoid paying their fair share of income taxes. Kevin LamarqueReuters Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec.

Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax. This creates a controversy that carried interest is a tax loophole. July 15 2016.

14 2018 1144 am ET. Managers are compensated through a flat 2 management fee and a 20 performance fee. The carried interest tax loophole is the poster child for the corrupting influence of money in politics.

Because its not classified as ordinary income general partners have to pay far less tax than they normally would. Carried interest is often the subject of political controversy because many believe it represents income that receives preferential treatment under the US. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains.

Senior White House economic advisor Jared Bernstein pointed to tax lobbyists as the reason the carried interest loophole was not included in a. A Primer on Carried Interest. 1639 would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate.

There is actually no such thing as the Carried-Interest Loophole. Others argue that it is consistent with the tax treatment of other entrepreneurial income. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax.

For 100 years since federal taxation of. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. Politicians from both parties often view carried interest as a tax loophole that overwhelmingly benefits wealthy investors.

Try as one might it is impossible to find a special tax rule that allows Hedge Funds and Hedge Fund managers to take advantage of the US tax code in a way that no other investor can. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Carried Interest Fairness Act of 2019 HR1735 S781 This legislation introduced in the 115th Congress closes the carried interest loophole which currently allows billionaire Wall Street money managers to pay lower tax rates than nurses or construction workers.

Napkins Investing Napkin Finance

Carried Interest Loophole Take On Wall Street

Hedge Papers No 60 New Jersey Hedge Funds And Their Billion Dollar Tax Loophole Hedge Funds Laquo Topic Laquo Hedgepapers Hedge Clippers

Carried Interest In Private Equity Calculations Top Examples Accounting

Carried Interest Archives The Progressive Investor

The Utility Of Carried Interest Liberrimus

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Carried Interest Definition History And Examples Marketing91

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Trump Obama And Bush Agree Close The Carried Interest Tax Loophole The Fiscal Times

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University